In the complex fabric of personal finance, the thread of credit scores intertwines, shaping a narrative that significantly impacts our financial paths. For many individuals, utilising a £2000 finance to carve out a favourable credit score might initially appear abstract. However, this guide aims to demystify this perception, revealing how this seemingly unassuming loan can be a powerful catalyst. Its influence extends beyond addressing immediate financial needs; it becomes instrumental in shaping a resilient credit history. Beyond being a mere numerical representation, your credit score mirrors your financial responsibility and trustworthiness in the eyes of lenders. When the £2000 credit is strategically utilised, it transforms into a versatile tool. Its purpose transcends immediate financial obligations, extending to the strategic enhancement of your creditworthiness. As we navigate the complexities of responsible credit-building, you will realise that this journey isn’t solely about managing current debts; it evolves into an investment in securing your financial well-being for the future.

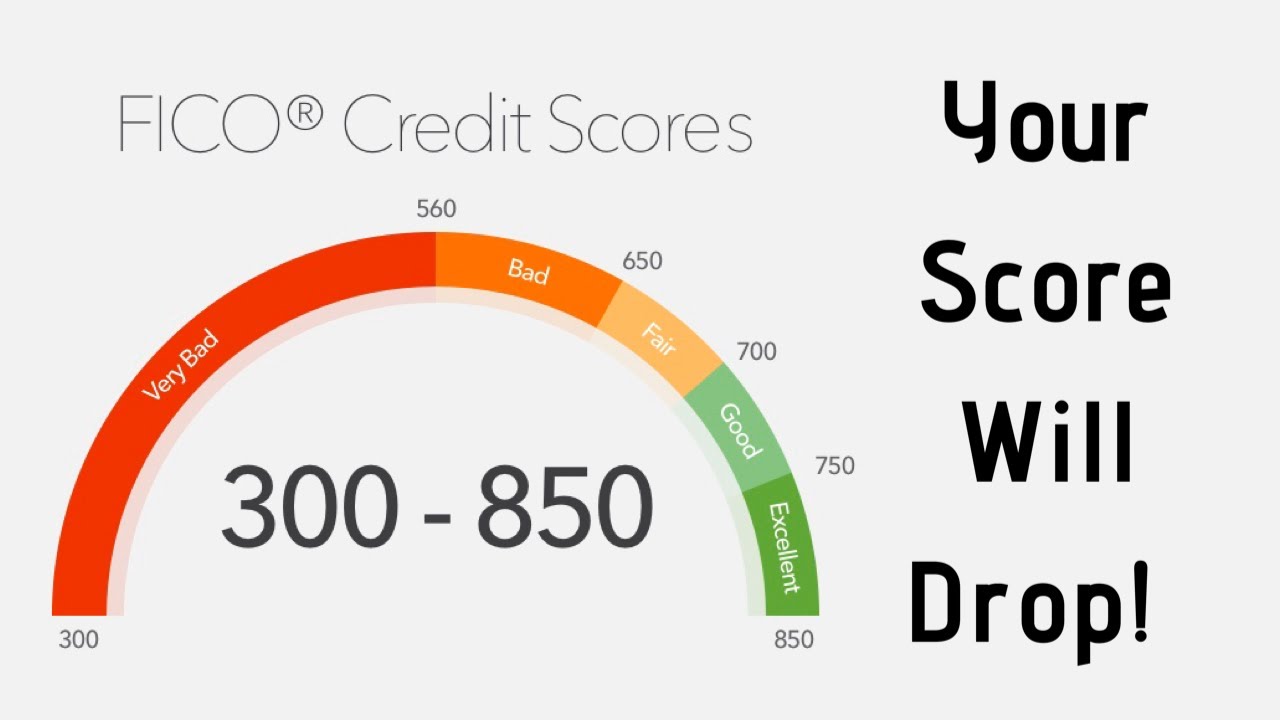

Understanding the Basics of Credit Scores

Before initiating the path to enhance your credit score using a £2000 loan, it is essential to grasp the basics. Your credit score serves as a numeric portrayal of your creditworthiness, influencing your capacity to obtain favourable interest rates for loans and credit cards. Important factors affect your score, such as payment history, credit utilisation, length of credit history, types of credit, and recent credit activities.

Assessing Your Financial Situation

A £2000 finance can be a powerful tool, but assess your financial situation before applying. Evaluate your income, existing debts, and budget. This assessment ensures the loan is a manageable addition to your financial portfolio, aligning with your overall financial goals.

Choosing the Right Loan

Not all loans are created equal. When considering a £2000 finance, explore different lending options. Conventional banks, credit unions, and online lenders provide different interest rates and terms. Select a loan with favourable terms that align with your financial capacity and goals. Remember, responsible borrowing is critical.

Strategically Using the £2000 Loan

Once you secure a £2000 finance, it’s time to deploy it strategically. Contemplate utilising the funds to settle high-interest debts, diminishing your overall credit utilisation. Alternatively, invest in areas that can yield returns, indirectly aiding in repaying the loan. This strategic approach maximises the positive impact on your credit score.

Timely Repayments: The Linchpin of Credit Building

Timely repayments are the linchpin of building credit responsibly. Allocate a portion of the loan to meet monthly payments promptly. Consistent, on-time payments prevent late fees and significantly improve your payment history, a critical component of your credit score.

Monitoring Your Credit Score Progress

As you navigate using a £2000 loan to enhance your credit score, diligent monitoring is paramount. Consistently review your credit report to pinpoint any discrepancies or inaccuracies. Monitoring allows you to witness firsthand the positive impact of your responsible credit-building efforts.

Conclusion

As we conclude this exploration into building credit responsibly with £2000 funds, it’s clear that this financial tool goes beyond mere monetary assistance. It’s a stepping stone towards a resilient credit history, unlocking doors to favourable interest rates and financial opportunities. By comprehending the intricacies of credit scores, making informed financial assessments, and strategically utilising the loan, you confidently empower yourself to navigate the complex realm of personal finance. Timely repayments and vigilant credit score monitoring are the cornerstones of your commitment to financial well-being. Embrace the transformative potential of a £2000 credit, not just as a financial aid but as a strategic investment in your enduring financial success.